In recent years, together with the technological development of the financial industry (FinTech) and of the compliance sector (RegTech), much emphasis has been placed on the significant contribution that artificial intelligence and big data analytics may provide in the detection and in the fight of money laundering and terrorist financing. Crime&tech, the spin-off company of Università Cattolica - Transcrime, has launched the study “Next Generation AML" in cooperation with SAS to understand to what extent banks, insurance and gaming companies make use of these advanced technological solutions in the Against Money Laundering (AML)/Financing of Terrorism (CTF) field, and to help to combat them.

In the fight AML and the CFT, a pivotal role is played by banks, insurance companies, financial institutions and other sectors which fall within the category of ‘obliged entities’: these are organisations which, according to AML/CFT legislation, have the obligation to carry out a due diligence of their clients with the aim to detect (and report to authorities if necessary) suspicious money laundering (ML) or terrorist financing (TF) activities. To date, the identification of the situations or the clients at high risk has been mainly based on deterministic rules: transactions higher than certain amounts, having a risky nature (e.g. intensive in cash) or carried out by clients with a certain profile (e.g. with previous criminal records). But these rules are not always able to detect actual ML/TF schemes, especially emerging ones for which there is no abundant evidence (e.g. those related to Covid-19 emergency).

Artificial intelligence is a field of computer science which focuses on the development of computer systems which can carry out activity typically performed by humans. In the AML/CFT field, artificial intelligence refers to the implementation of algorithms (i.e. machine learning, natural language processing) to support AML personnel in their daily activities. These technological solutions may help not only obliged entities (i.e. banks, insurance companies, gaming providers) but also public authorities of the AML/CFT domain (i.e. Financial Intelligence Units, financial police, AML supervisory agencies) in analysing more effectively large amounts of data, coming from different sources, and identifying suspicious transactions which traditional AML solutions – based on deterministic rules – do not detect.

Notwithstanding these claims, several doubts about the actual use of these technological solutions remain. No previous study has systematically analyzed this topic in Italy and knowledge is still scarce also at the international level.

The study “Next Generation AML”. It is the first survey ever carried out in Italy on the use of artificial intelligence and big data for AML/CTF purposes by banks, insurance, and other obliged entities. It analysed the typologies, costs, risks, and benefits of the advanced technological solutions in the AML/CTF field through a survey among 43 obliged entities representing almost a half of the financial sector (NACE K) and the gaming sector (NACE R.92) in Italy. The study also entailed interviews and a focus group with selected survey respondents.

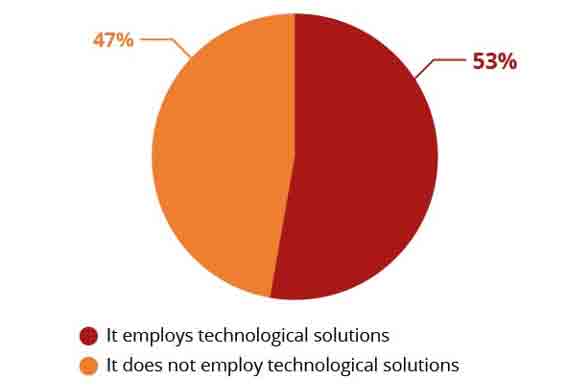

The results showed that the use of advanced technological solutions for AML/CFT purposes is still in its infancy in Italy. Only the 53% of the respondents employ them, a percentage that drops to 39% considering small obliged entities (less than 3,000 employees). However, the 84% of the respondents plan to invest in these solutions in the future. Artificial intelligence and big data analytics are the most employed solutions. The former is mainly used for transaction monitoring while the latter is fairly distributed across all the phases of the AML/CFT process. Biometrical technologies, blockchain/distributed ledger technology (DLT) and cloud computing are the least employed.

Figure 1 – Does your organization employ technological solutions in the AML/CFT field? (N=43)

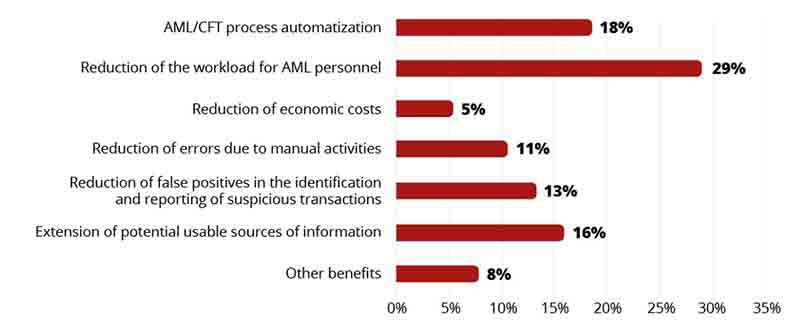

The high costs of development seemed to be the main barrier to the adoption of these advanced technological solutions. The respondents also claimed several difficulties in customizing/integrating them in the traditional AML/CFT systems already in use and interpreting their results. The last issue seems to be particularly influenced by the AML personnel’s lack of data analytics skills: all the respondents would hire new personnel with a strong understanding of mathematics, statistics and computer science. Despite all these barriers, the potential benefits of these solutions seem to be relevant. The 29% of the respondents highlighted that these solutions lighten the workload of AML personnel, allowing them to reduce the effort spent on manual and repetitive tasks. The automatization of the AML/CFT process is particularly relevant for small obliged entities while the reduction of errors due to manual tasks is more relevant for large ones.

Figure 2 – What is the main benefit from the employment of technological solutions in the AML/CFT field?

The 84% of the respondents plan to invest in these solutions in the future. The 77% of the respondents would need additional economic resources and the 48% do not have a dedicated budget. Given these issues, it should not surprise that the 68% of the respondents consider potential economic incentives (e.g. tax cuts) as an effective measure to incentivize investments in this area. Also, educational initiatives (e.g. training/refresher courses for AML personnel), work tables with AML supervisory authorities and publicly available demo of these solutions are suggested as useful measures.

In conclusion, technological solutions will play an ever-increasing role in the AML/CFT domain. Nevertheless, obliged entities should overcome a widespread “cultural resistance” towards these new solutions and the tendency to rely on traditional ones. Artificial intelligence is still considered as a “black box” which AML personnel do not fully understand and manage. As a consequence, the use of these solutions is still limited, especially considering that, on the contrary, AML supervisory authorities require obliged entities to understand and be able to demonstrate how AML models produce certain outcomes. Investing in human resources seems to be the key to take full advantage of these technological solutions. Obliged entities should not only strengthen the data analytics skills of their AML personnel but also their knowledge on schemes of money laundering and financing of terrorism, thus making them able to effectively distinguish between statistical anomalies and actual criminal behaviours.

‘Next Generation AML’ is only one of the initiatives that Crime&tech has launched in the field of AML/CFT. Crime&tech translates the research of Transcrime into tools, instruments and models for preventing crime. In this area, Transcrime is analysing frequent and emerging money laundering and terrorist financing schemes, and the modi operandi employed by criminals in using legal persons to conceal illicit financial flows. On this basis, Crime&tech has developed solutions based on artificial intelligence to early-detect and assess financial crime risks. Last of the list, the project Cut-the-Cord (CTC), awarded by the European Commission to Crime&tech together with international partners, ABI-Lab, the Italian Banking Association, and SIA, the Italian digital payment service company. CTC will develop innovative artificial intelligence solutions to analyse financial transactions and cybercurrency payments and early detect terrorist financing activities.